Give

What matters to you?

As part of our mission to Activate Generosity for a Strong Community, the Otsego Community Foundation strives to make giving back a streamlined process. For 30 years, we have been helping people like you make the most of your charitable giving and philanthropic wishes.

Give to an Existing Fund

Give to a fund that directly supports our work or to funds supporting a variety of causes. Donate as part of your annual giving, to honor a loved one, or simply because it does good.

Establish a Fund

Support a cause. Give directly to organizations you care about. Create a family tradition of giving. Honor someone or pay tribute to a loved one’s memory.

Plan Your Legacy

Including the Otsego Community Foundation in your estate plan is an easy way for you to make a significant impact on community needs and create a legacy that lasts forever.

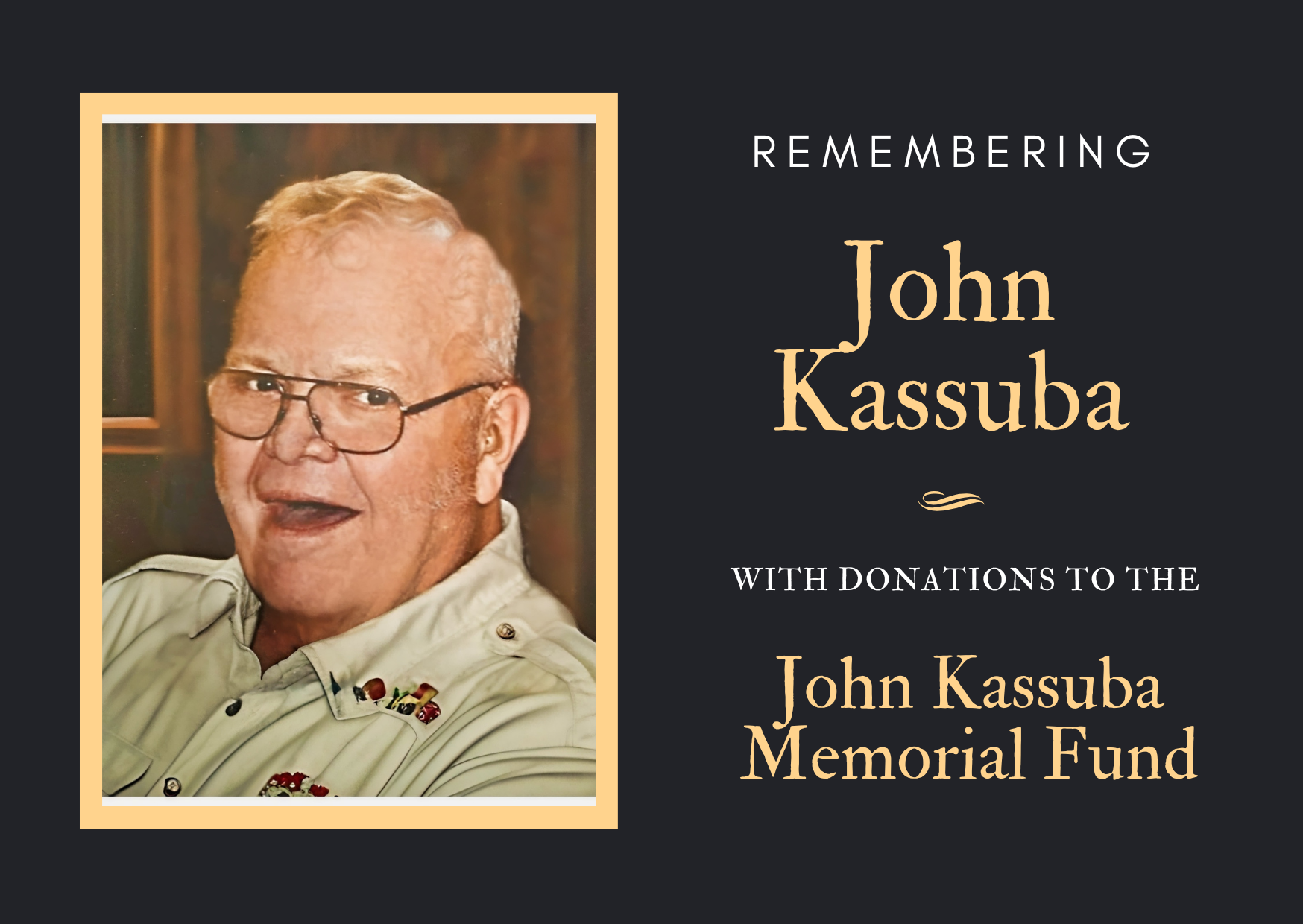

Gifts can be made in memory of “Big John” Kassuba — a beloved husband, father, grandfather, and proud member of the Vanderbilt community. Known for his deep love of the outdoors, storytelling, and music, John enriched the lives of many through his work, volunteerism, and generous spirit. Contributions to the John Kassuba Memorial Fund at the Otsego Community Foundation will help continue his legacy of community and connection.

To give online, click on the graphic above.

To give by check, please mail your gift to:

Otsego Community Foundation

P.O. Box 344, Gaylord, MI 49735

Please make checks payable to Otsego Community Foundation and note JOhn Kassuba Memorial Fund in the memo line.

If you’d like to support ongoing recovery efforts from the recent ice storm, please select the Disaster Response Fund from the dropdown menu—or choose another OCF fund that’s meaningful to you.

To date, the Disaster Response Fund has granted $83,500 to support urgent relief efforts across our community. These funds have helped frontline organizations provide food, shelter, and essential services to those in need. Grantees include:

Otsego County United Way, Otsego County Food Pantry, Efree Church, The Salvation Army, The Refuge, Johannesburg-Lewiston Schools, Vanderbilt School, Gaylord Community Schools, Giving Tree Food Pantry, and Vanderbilt Food Pantry.

As we wrap up the immediate relief phase, we’re now shifting into short-term recovery. This next chapter involves working closely with community partners to identify emerging needs and ensure a thoughtful, impactful response. We are committed to keeping you informed as our efforts continue—thank you for standing with Otsego County.

To give online, click on the graphic above.

To give by check, please mail your gift to:

Otsego Community Foundation

P.O. Box 344, Gaylord, MI 49735

Please make checks payable to Otsego Community Foundation and note Disaster Response Fund in the memo line.

Donate to a fund that directly supports the good work of the OCF, or we are also home to numerous funds established by generous individuals, families, and businesses. These Funds make grants to support organizations or areas of interest. You can donate to any of these funds right now. Make a donation to celebrate an event or milestone, give in memory of a loved one, or add to a local organization at the OCF.

All OCF funds are open-ended and accept gifts at any time.

To review our gift acceptance guidlines click here.

Use the button below to see our full list of funds.

Tax ID Number: 38-3216235

How to Give

Mail a check to:

Otsego Community Foundation

PO Box 344

Gaylord, MI 49734

Make checks payable to OCF, and include the fund name in the memo line.

Or click the button below to give online now:

Did you know that thousands of companies match donations by employees to non-profit organizations? Click the button to learn more about matching gifts.

Testimonials

What Donors are Saying

“Partnering with the Otsego Community Foundation seemed like the best way to connect with and to benefit our biggest resource: our children. Making higher education more affordable is a goal of the Readers’ Fund, especially when it is achieved through opportunities in the high school curriculum,” Betsy Sanders.

“Just as many people, Herman Lunden lived in a number of communities, but he had chosen a 40 acre lot in what is now the Pigeon River Country to build his retirement home. He never had the chance to build that log home but through being a part of the OCF this endowment can always be giving back to the community that he loved and that cared about him.” Pat Lunden

“We are grateful to have OCF as a vital organization for the betterment of our community and world!!

Erik and Brandie Meisner

Establish a Fund

If you are interested in starting your own fund and making a bigger impact with your giving, we can help. Our funds let you give in your own way and on your own timetable. Tell us what you are passionate about, and we will take it from there. Choose the one that is the right fit for you.

A fund can be established in your name or in the name of your family, your organization or anyone you wish to honor. Funds can also be established on an anonymous basis. All grants made—today and in the future—are awarded to charities in the name of the fund. It’s a beautiful way to link your community investment with a special person or purpose, forever.

Fund for the Community

A Fund for the Community is the most flexible of the OCF fund types. Gifts from these funds will be used to address significant challenges and opportunities in our community. Our program experts determine where grants from these funds can have the largest impact. As community needs change, so will the projects these funds support.

Field of Interest Funds

A Field of Interest Fund allows you to target your gift toward a specific area of community life that is important to you: arts, environment, health, youth, etc. Our program experts award grants to nonprofit organizations and programs that are making a difference in the area you select.

Donor Advised Funds

A Donor Advised Fund (DAF) provides a simple, flexible, and tax-efficient way to streamline your charitable giving. You make a gift and remain actively involved in grantmaking. You will determine which nonprofit organizations you wish to support. Creating a DAF with the OCF will streamline the process for meeting your philanthropic goals.

Designated Funds

A Designated Fund allows you to support the good work of your most valued nonprofit organization long-term. The fund creates a permanent income stream for the nonprofit of your choosing. Yearly grant requests are made by the board of directors of the chosen organization.

Scholarships

Invest in our community’s future by helping students reach their academic and career goals. OCF scholarships can benefit individuals attending specific institutions or those with particular backgrounds or interests. You may also set guidelines for candidate selection and scholarship awards. Scholarship awards are made by the Scholarship Committee of the OCF yearly.

The Legacy Society recognizes individuals and couples who have named the Otsego Community Foundation as the beneficiary of any type of planned or deferred gift. The purpose is to acknowledge and thank those who have made these gifts and to encourage and inspire others to do the same. Members of the Legacy Society will be recognized in our publications.

Legacy Society Members

Brad & Dana Bensinger

Scott Chesley

Bill & Liz Forreider

Duane Jasinski

Susan A . Jordan

Bruce & Tammy Kohnert

Hans and Dolores Kuehlenthal

Mary B. Seger

James Roth

Tom Wagar

Aara Sue Willison

Janet M. Allen & James C. Smith Jr.

Tom Wager Legacy Society Member

My Dad, Ford Wagar, was pretty frugal and like the saying goes, the apple doesn’t fall far from the tree. Giving back to the community has never been a problem. We always gave to the cause, with our time and money but never the “BIG” money. That frugal upbringing, always suggesting, “save your money for a rainy day” and we did just that. Following that game plan has paid off and now I have the resources available to accomplish two goals, to give back to the community and be remembered.”

Scott Chesley Legacy Society Member

“I think what I like best about the Otsego Community Foundation is it’s the one place where you can give and that gift keeps on giving forever.”

Bill & Liz Forreider Legacy Society Members

“The Legacy Society allows us the opportunity to give to the community we love so much, long beyond our time. Our gratitude can be expressed forever!”

Hans and Dolores (Dee) Kuehlenthal Legacy Society Members

Why am I a member of the Otsego Community Foundation Legacy Society? That is a very easy answer: Love for this amazing community. My family has lived in Gaylord for 6 generations, and I want wonderful things to happen past the generations that follow me. I have complete trust in the leadership and knowledge of the OCF and know that my legacy will help shape a future that is strong and bright.

Getting Started

What matters to you?

We can help you create giving solutions that reflect your goals, values and motivations. Consider the following questions to prepare for conversation;

Questions

(989) 731 – 0597

Info@otsegofoundation.org

01.

Consider the charitable intent, what area of the community do you want to benefit?

02.

How long do you want it to last?

03.

What do you want to name it?