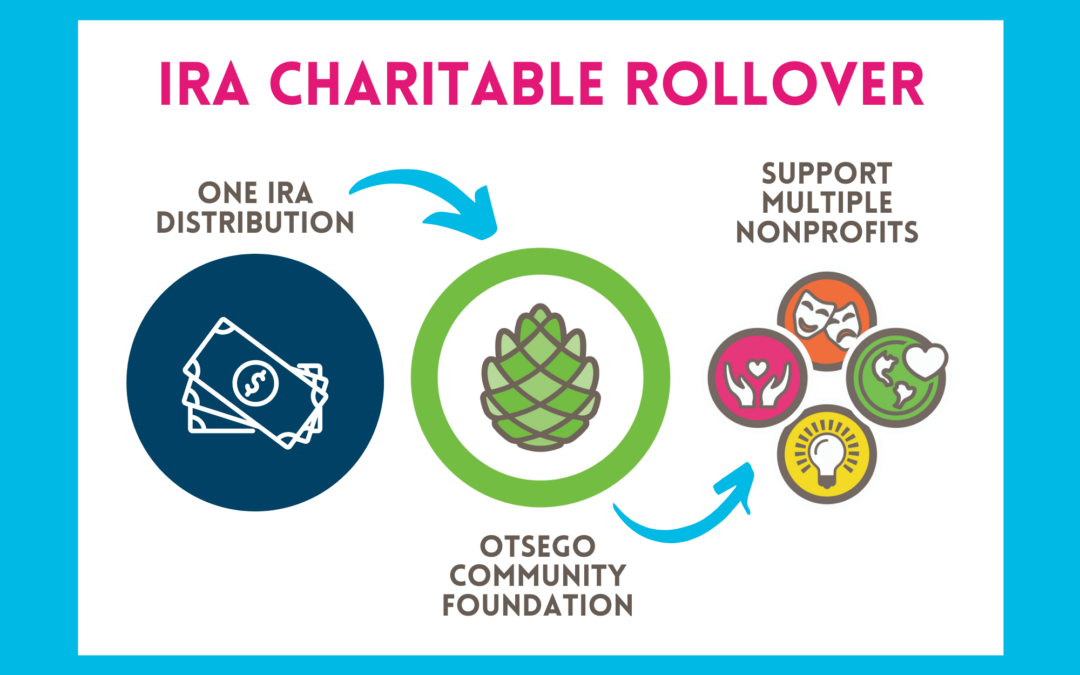

The IRA charitable rollover, also known as a qualified charitable distribution (QCD), allows IRA holders, age 70 ½ or older, to donate to a qualified charity from their Traditional or Roth IRA (including inherited) tax-free.

Requirements

- The donating IRA holder must have attained age 70 ½ on or before the date the QCD check is issued. If it is an inherited IRA, the beneficial owner must have attained age 70 ½ or older.

- The funds must be issued directly to a qualified charity from a Traditional or Roth IRA.

- Generally, a qualified charity includes most public charities, including religious institutions, certain veterans’ organizations, fraternal societies, and community foundations that provide scholarships. The charity also must be one to which deductible contributions may be made.

- The donor cannot receive any benefit* from making a QCD, and the QCD cannot be deposited by the charity into a donor advised fund.

- The maximum amount of QCDs that can be excluded from an individual’s taxable income is $100,000 annually per donor. However, deductible contributions made during or after the year an individual turns age 70 ½ will reduce the amount that may be excluded. Consult your tax professional to determine the tax-free amount you can withdraw.

- Checks must be issued by December 31 in order to apply to the current calendar year.

*Individuals can make a one-time QCD of up to $50,000 to entities previously ineligible to receive QCDs, including charitable remainder annuity trusts, charitable remainder unitrusts, and charitable gift annuities that meet certain criteria.

To what Nonprofits can I make an IRA charitable rollover?

IRA charitable rollover gifts must be made directly to a 501(c)(3) public nonprofit such as the Otsego Community Foundation. The OCF can accept IRA charitable rollover transfers to start a new fund or give to an existing fund.

Qualifying funds include:

- Funds for the Community – Funds for the Community are a collection of funds established and grown by generous individuals, families, and businesses, complementing the Community Fund. These funds are unrestricted in nature, meaning the Otsego Community Foundation and Grants Committee ultimately decide how grant dollars from each fund would be best utilized within the community each year.

- Designated Funds – Designated Funds are established to benefit designated nonprofits, educational, or religious institutions. Individual donors or the nonprofits themselves may establish these funds, which provide support now and enhance the resources the organizations will need in the future.

- Field of Interest Funds – Field of Interest Funds enable donors to focus their giving on the issue or causes they care about most. These causes include arts and culture, youth, education, mental health, and more.

- Scholarship Funds – Scholarship Funds support undergraduate and graduate education, professional development, and other educational enrichment opportunities.

Click here for a complete list of funds at the OCF.

How do I initiate an IRA charitable rollover?

- Contact Dana Bensinger at 989-731-0597 or dana@otsegofoundation.org.

- Seek advice from your financial or legal advisor.

- Ask your IRA administrator to initiate the transfer to the Otsego Community Foundation. (Note: To be tax-free, the donation must go directly from your account to the Community Foundation without passing through you.)